Expert Tips for Senior Cardholders

Making savvy financial decisions is crucial, especially for seniors navigating retirements and fixed incomes. Credit cards tailored for older adults can offer financial empowerment when used wisely.

Maxing Out the Perks of Senior Credit Cards

First things first, it’s essential for seniors to select a credit card that aligns with their financial habits and goals. If travel, dining out or shopping are regular activities, seniors should look for cards that offer rewards, such as cash back, points, or miles. Keep an eye out for cards that cater specifically to seniors, providing additional perks such as discounts on medical expenses or pharmacy purchases.

Securing a card with no annual fee can help keep costs down, which is especially important on a fixed income. Seniors would also do well to zero in on cards that provide fraud protection, seeing as seniors are often targets of fraudulent activity. In addition, some credit cards offer extras like affordable credit score monitoring, which can be beneficial.

Rewards and Benefits Tailored for Seniors

With the right credit card, a senior can maximize rewards and benefits to significantly enhance their financial situation. Here are tips to do exactly that:

Establish Financial Flexibility through Strategic Use

Credit cards aren’t just about spending, they’re tools for managing cash flow effectively and addressing unexpected financial needs.

Smart Security Measures for Senior Finances

As seniors are particularly vulnerable to financial exploitation, robust security measures are necessary. Keeping track with technology that offers secure payment options, like tap to pay or wallet apps, minimizes the chance of theft. Vigilantly examining statements each month allows seniors to dispute any unauthorized charges quickly.

Choosing credit cards with zero liability policies ensures that in the event of a security breach, the cardholder isn’t on the hook for fraudulent charges. Additionally, it's prudent to inform emphasized texttrusting family members about card details and where to find them, so any suspicious activity can be identified and stopped if the senior cannot manage it.

The Mindful Integration of Senior-oriented Credit Tools

Introducing a credit card into the mix doesn't have to be daunting; instead, it can be quite empowering. Here's how societal expectations can be managed:

-

1

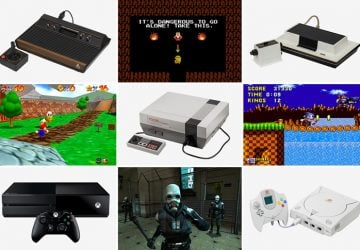

Ultimate Countdown: The 20 Very Legendary Gaming Consoles Ever!

-

2

Master the Art of Flossing for a Stunning Smile and Healthy Gums

-

3

Explore the Horizon with the Kona SUV: Hyundai's Trailblazing Crossover Redefines the Road Ahead

-

4

Affordable Cell Phones for Seniors Today

-

5

Full Dental Implants in One Day Explained